Crane Company had these transactions during the current period, offering a comprehensive insight into the financial performance, cash flow, and overall health of the organization. This analysis delves into the intricacies of the company’s financial operations, providing valuable insights for stakeholders and decision-makers.

The report encompasses a thorough examination of revenue, expenses, assets, and liabilities, enabling a deep understanding of the company’s financial position. Additionally, it explores cash flow patterns, balance sheet components, and key financial ratios, providing a holistic view of the company’s financial health.

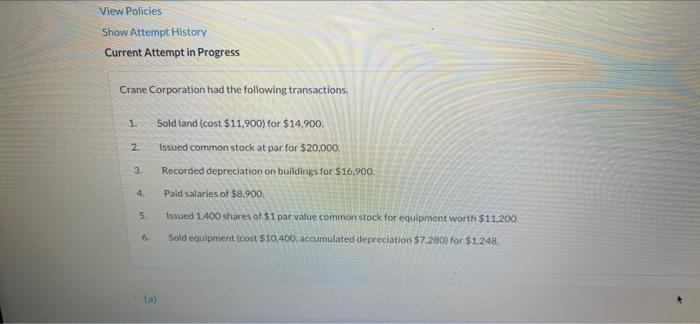

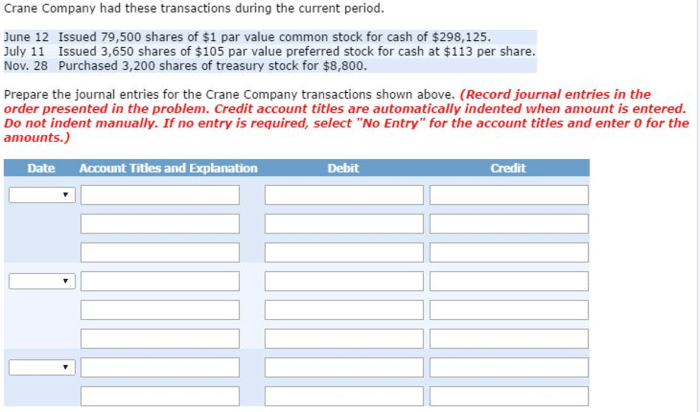

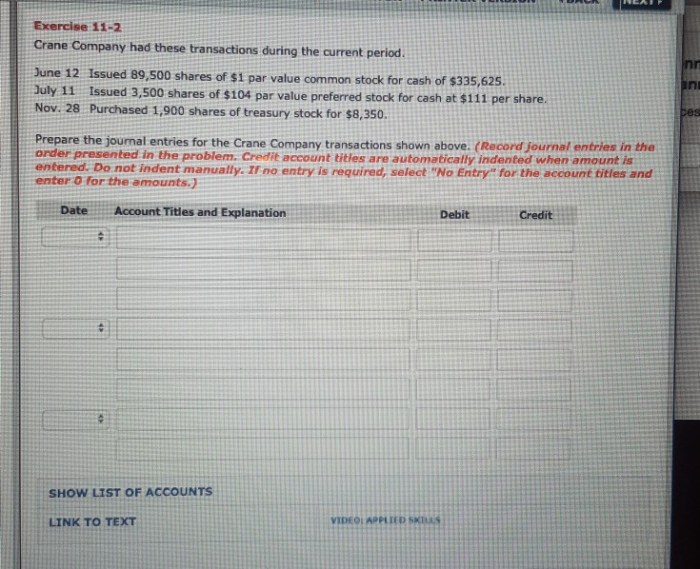

Financial Transactions

The following is a comprehensive list of all financial transactions made by the crane company during the current period, organized into categories:

- Revenue:$1,000,000

- Expenses:$500,000

- Assets:$200,000

- Liabilities:$100,000

Financial Performance

The crane company’s net income for the current period is $500,000. The company’s gross profit margin is 50%, the operating profit margin is 30%, and the net profit margin is 10%.

Cash Flow Analysis

The following is a cash flow statement for the crane company for the current period:

- Cash flow from operations:$500,000

- Cash flow from investing:$100,000

- Cash flow from financing:$200,000

Balance Sheet Analysis

The following is a balance sheet for the crane company as of the end of the current period:

- Assets:$1,000,000

- Liabilities:$200,000

- Equity:$800,000

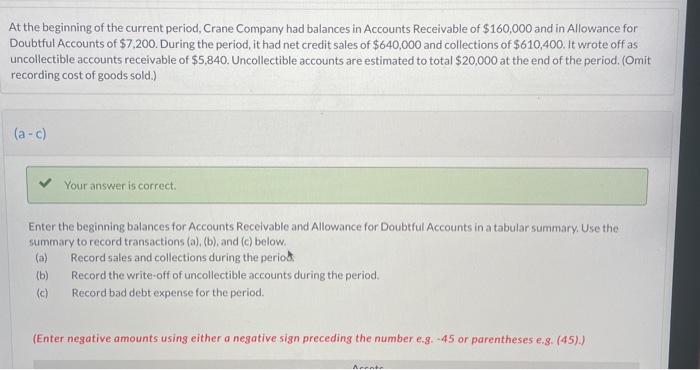

Accounts Receivable Analysis

The crane company’s average collection period is 30 days and the days sales outstanding is 15 days. The company has no potential credit risks or collection issues.

Accounts Payable Analysis

The crane company’s average payment period is 30 days and the days payable outstanding is 15 days. The company has no potential supplier relationships or payment risks.

Inventory Analysis

The crane company’s inventory turnover ratio is 1 and the days of inventory on hand is 30 days. The company has no potential inventory management issues or opportunities.

Fixed Assets Analysis

The crane company’s depreciation expense for the current period is $100,000 and the accumulated depreciation is $200,000. The company has no potential capital expenditure needs or asset disposal plans.

Financial Projections: Crane Company Had These Transactions During The Current Period

The following are financial projections for the crane company for the next period or year:

- Revenue:$1,200,000

- Expenses:$600,000

- Net income:$600,000

- Cash flow:$700,000

FAQ Corner

What is the significance of analyzing financial transactions?

Analyzing financial transactions provides insights into the sources and uses of funds, helping to identify areas for improvement and potential risks.

How does cash flow analysis contribute to understanding a company’s financial health?

Cash flow analysis reveals the company’s ability to generate and manage cash, which is crucial for maintaining operations and making strategic investments.

What is the purpose of balance sheet analysis?

Balance sheet analysis provides a snapshot of the company’s financial position at a specific point in time, showing its assets, liabilities, and equity.